Institutional-Grade Logic

Stop guessing. Replace emotional decision making with rigorous mathematical probability.

Plug-and-Play

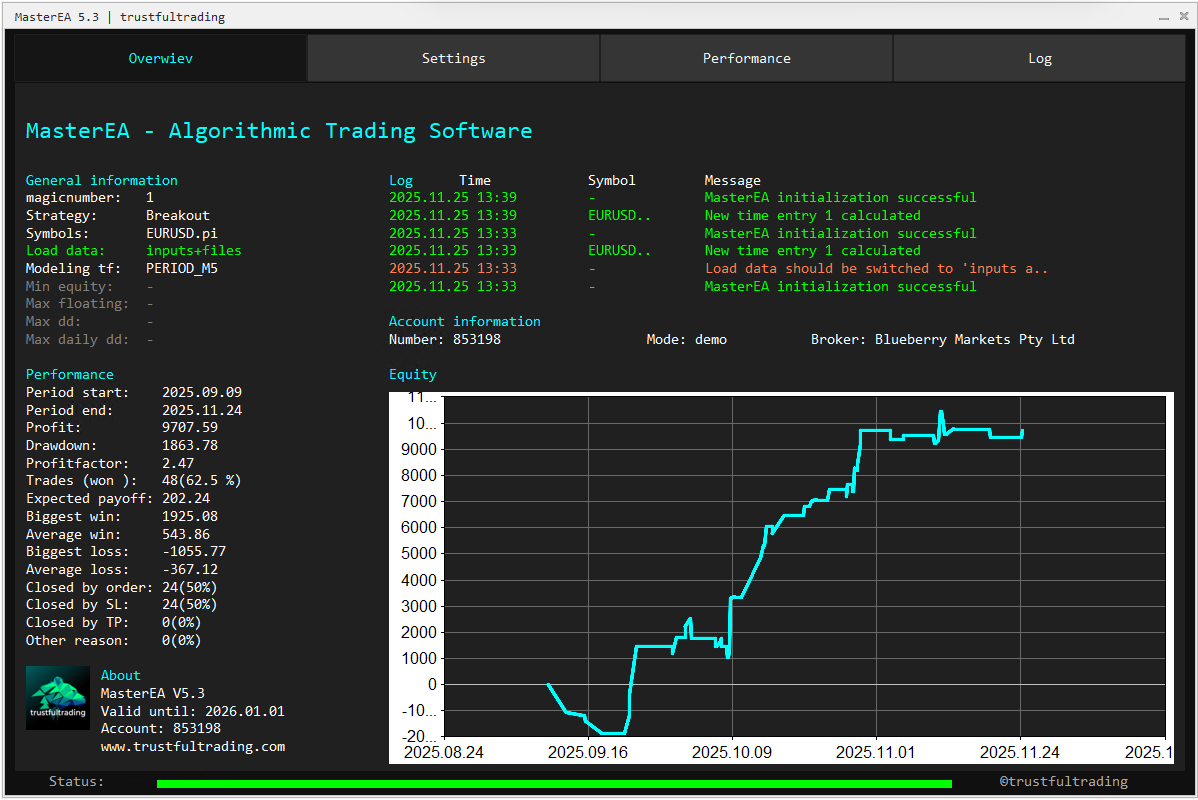

MasterEA is designed as a true plug-and-play solution: install it on your MT5 platform, select your risk level and strategy, and it is ready to trade within minutes. Default settings are pre-optimized, this lowers the chance of configuration errors, and lets you focus on capital allocation and monitoring instead of technical setup.

Engineered for Longevity

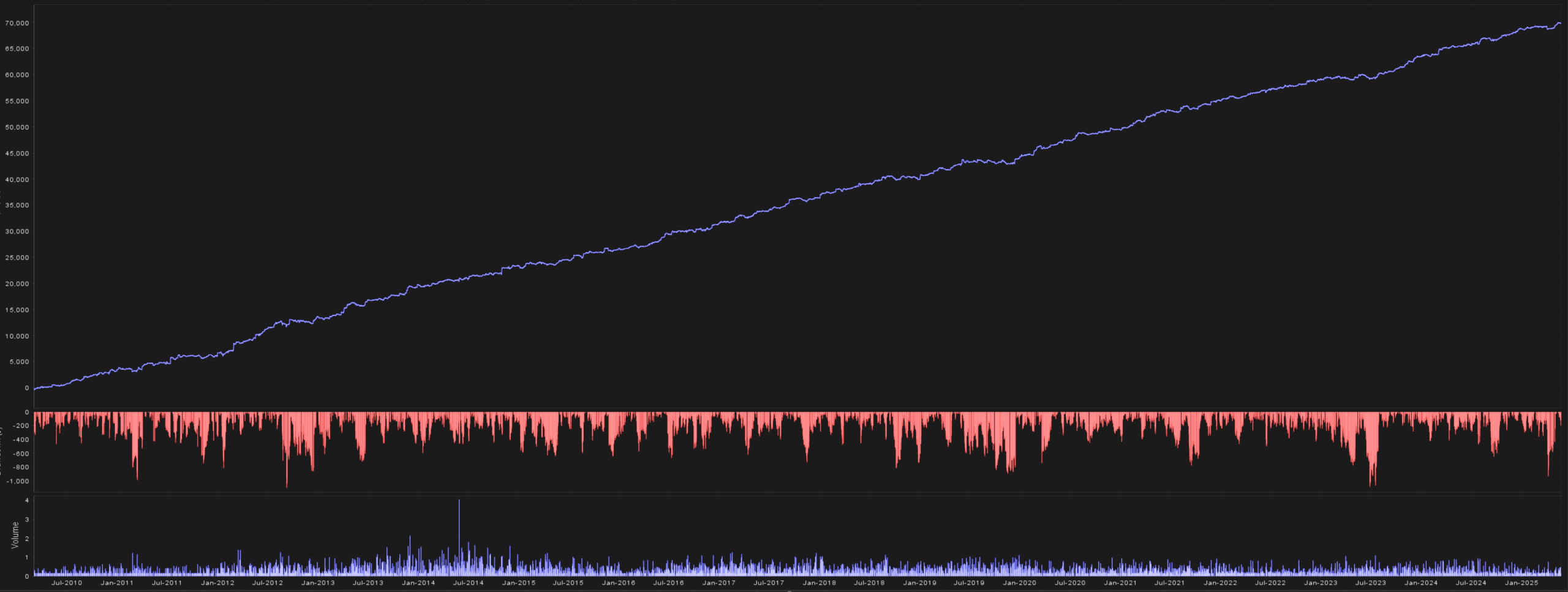

Most automated systems fail because they over-optimize for the past. MasterEA is built on robust, first-principle trading concepts designed to survive changing market regimes.

Risk-Adjusted Sizing

MasterEA moves beyond static lot sizes. It dynamically adjusts position exposure based on current market volatility, ensuring risk is normalized across different asset classes.

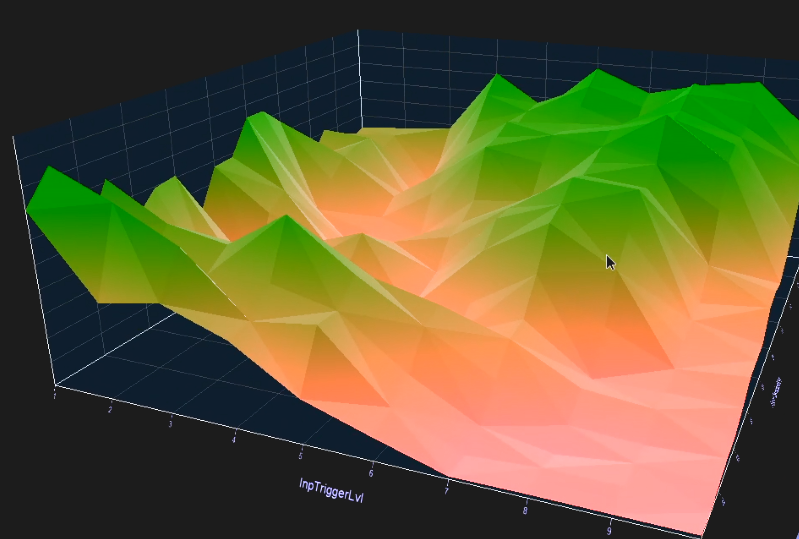

Quantitative signal Fusion

Aggregates signals from multiple statistical indicators into a single weighted confidence score before executing any trade.

Multi-Style Trading Allocation

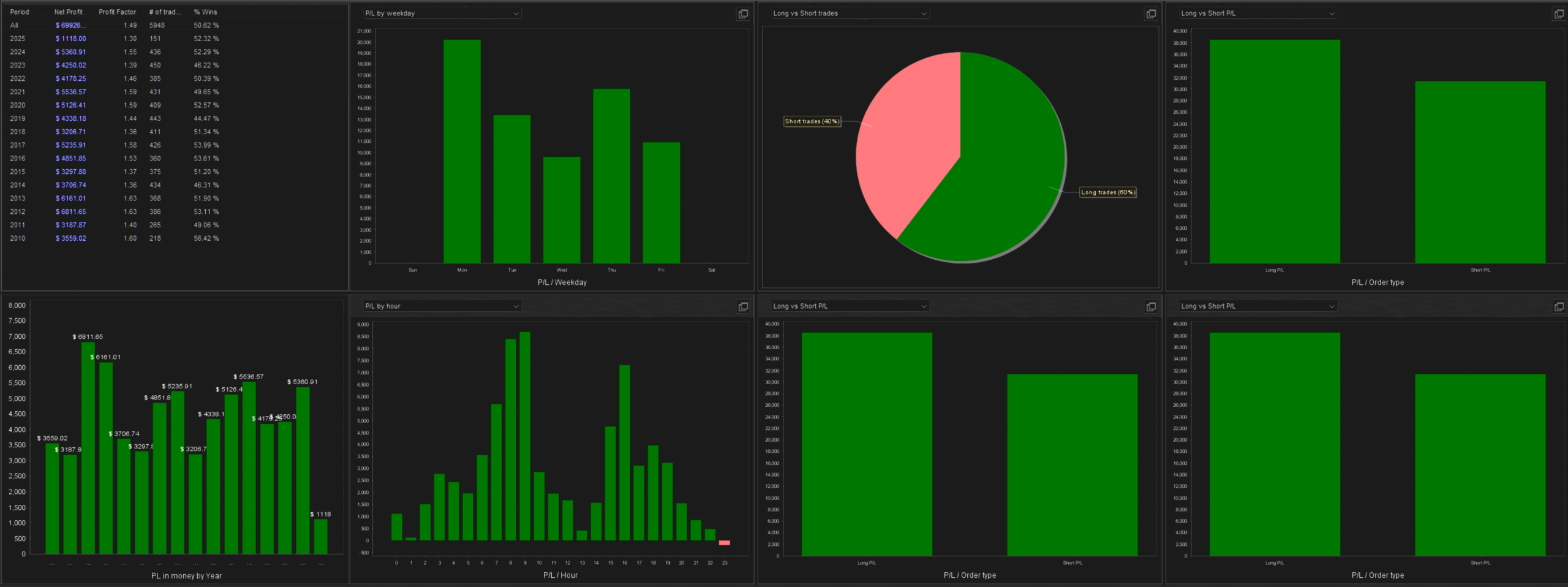

MasterEA allocates risk across several trading styles instead of relying on a single market approach. Trend-following, mean-reversion, breakout and momentum each react differently to volatility and market structure, reducing dependence on one environment and broadening the range of regimes the portfolio can capture.

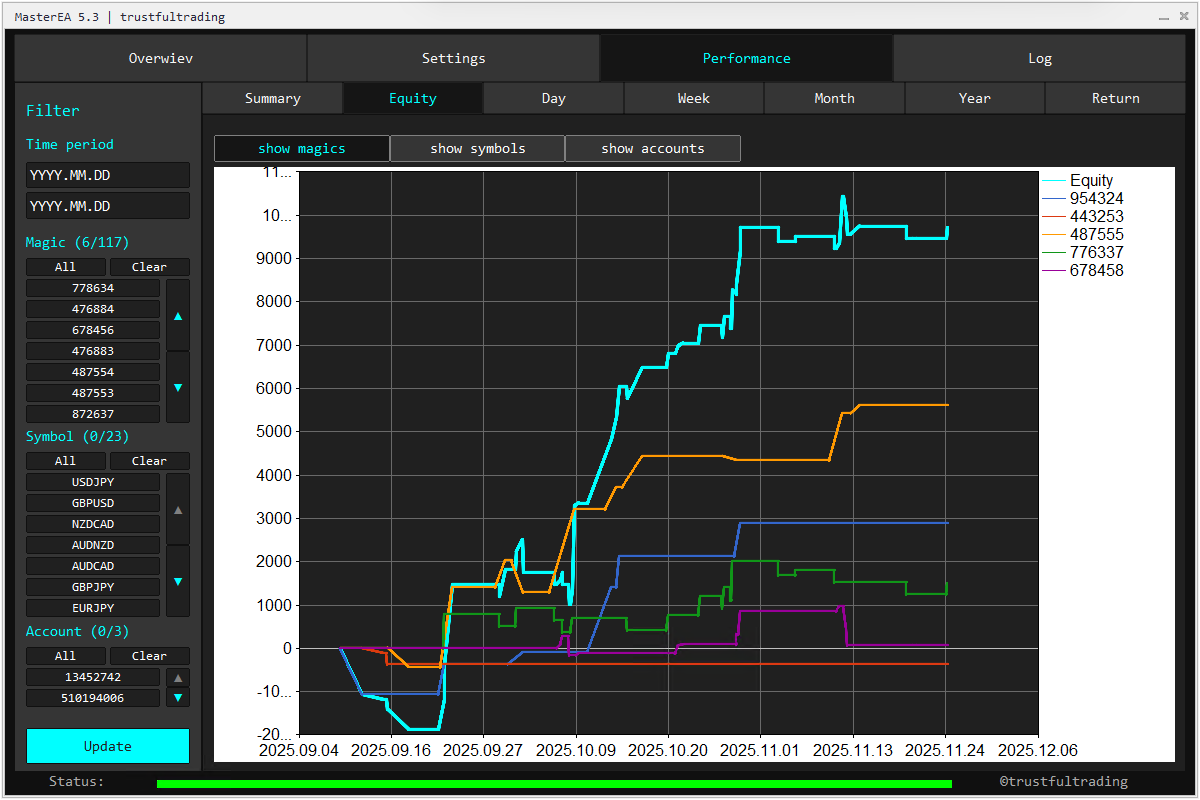

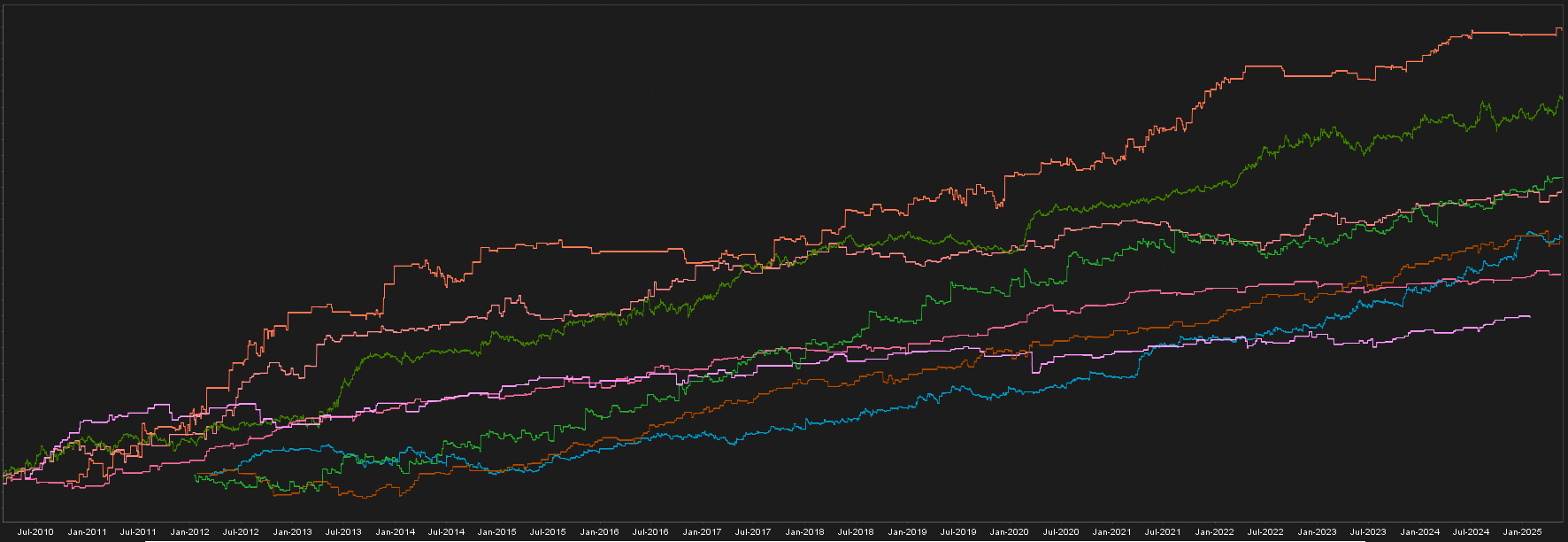

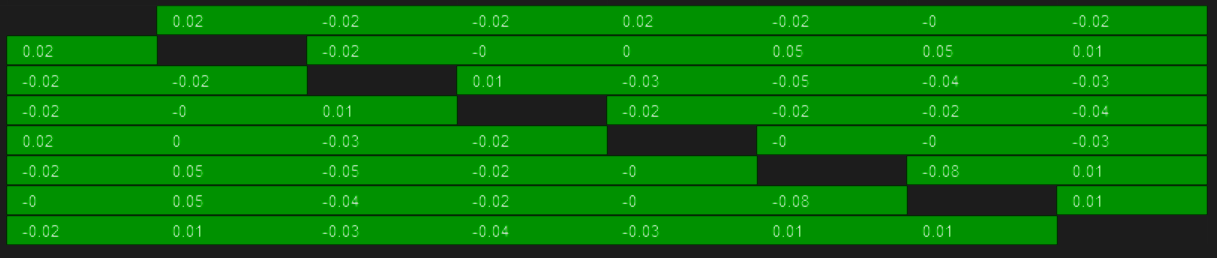

Market Composition Diversification

MasterEA spreads exposure across multiple, low-correlated markets instead of concentrating risk in a single asset. Capital is allocated across currency pairs, indices and commodities with different volatility profiles and trading sessions, smoothing the equity curve and reducing the impact of isolated market shocks on overall portfolio performance.

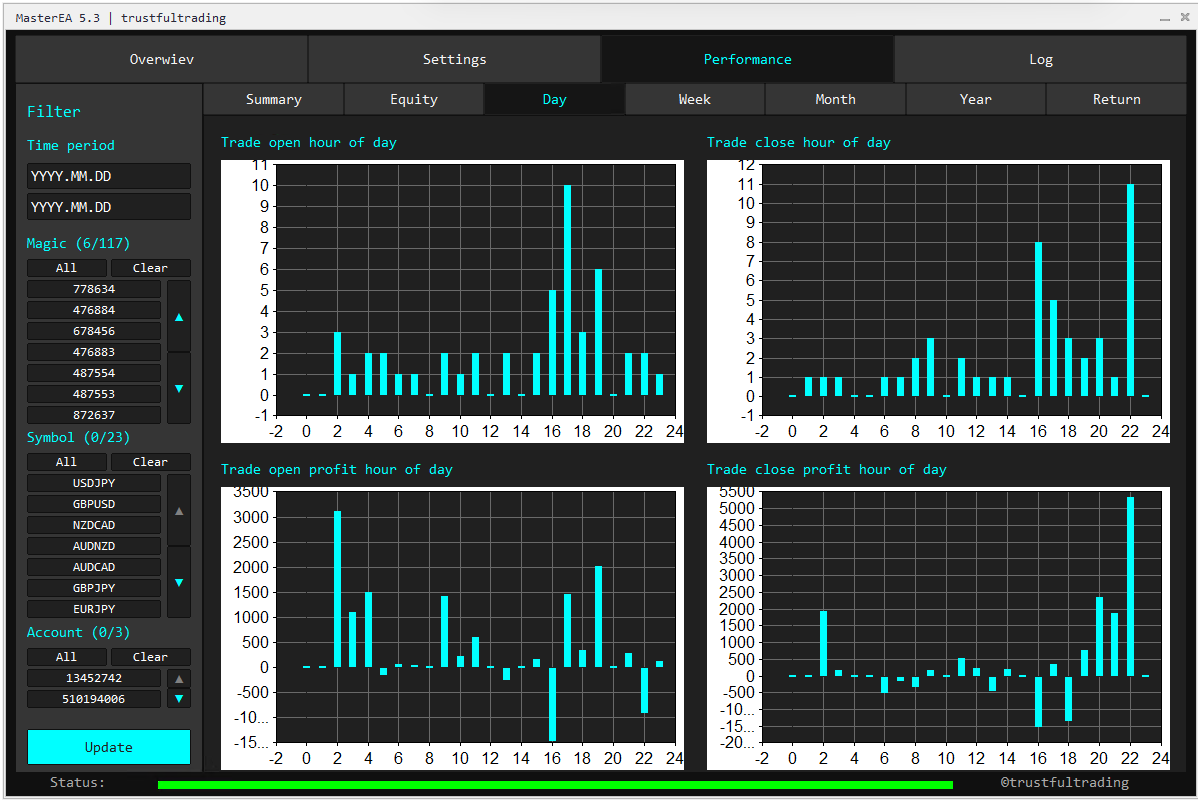

Multi-Timeframe Execution Layer

MasterEA distributes risk across multiple time frames instead of relying on a single trading horizon. Short-term, swing and higher-timeframe signals are processed within one engine, so entries and exits are informed by both immediate price action and broader market context, reducing timing risk and providing a more continuous stream of trading opportunities.

Multiple systematic Strategies

A robust portfolio isn’t just about more trades. It’s about decorrelation. MasterEA combines logic that profits in varying market conditions.

Total Control.

At a Glance.

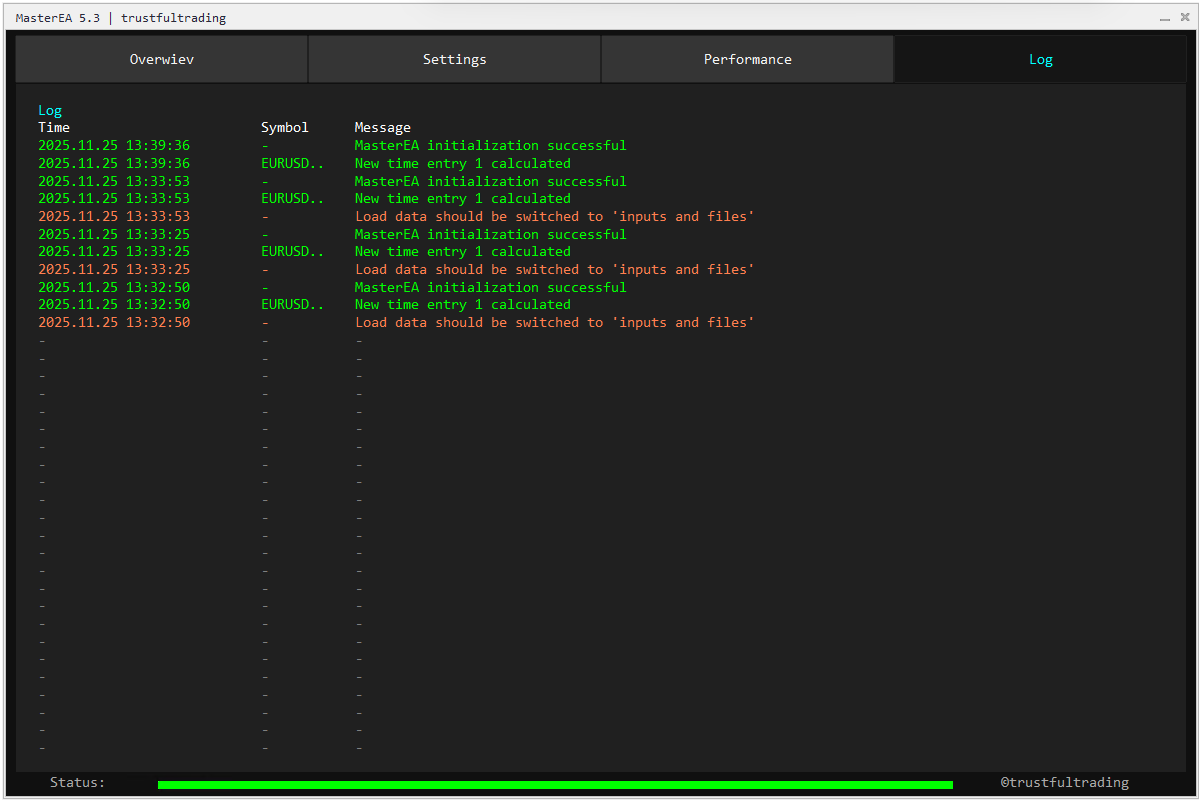

MasterEA integrates directly into your MT5 chart with a sleek, non-intrusive graphical panel. Monitor performance, manage risk, and systematically compound your trading capital over time.

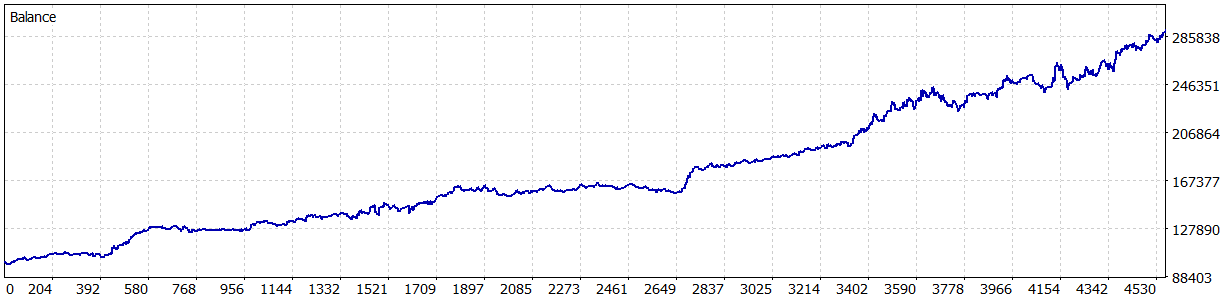

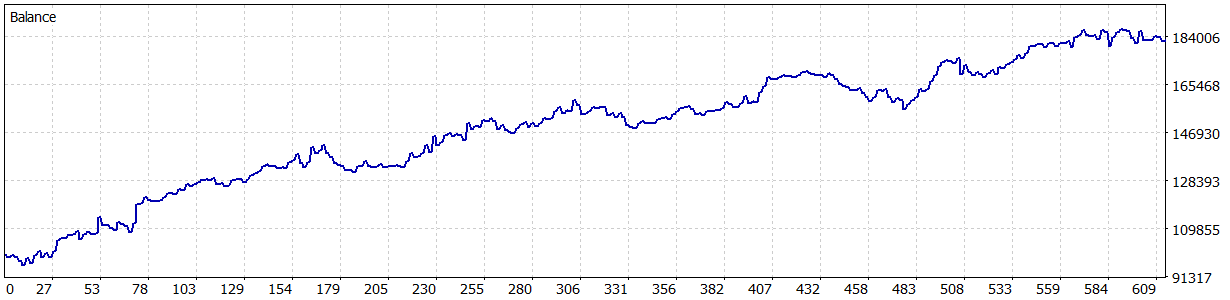

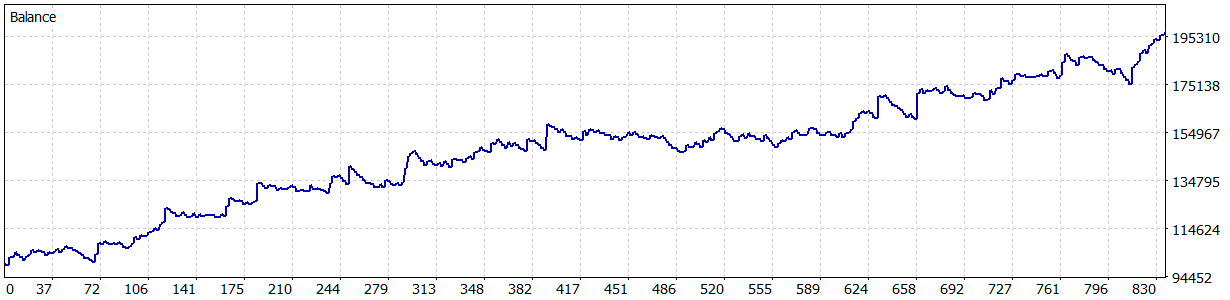

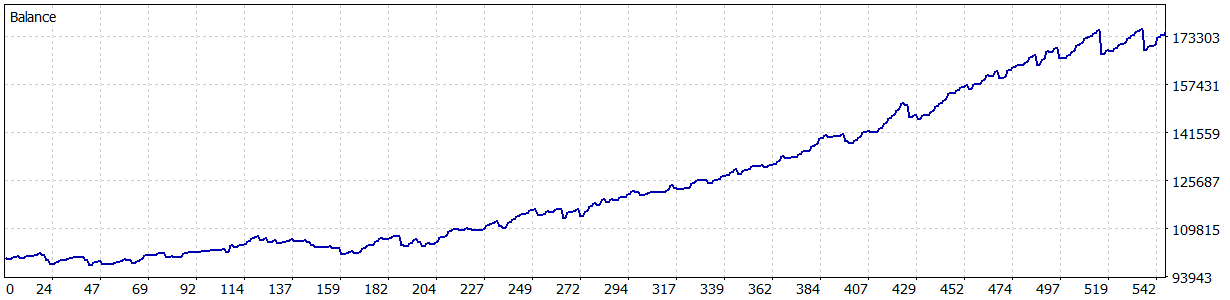

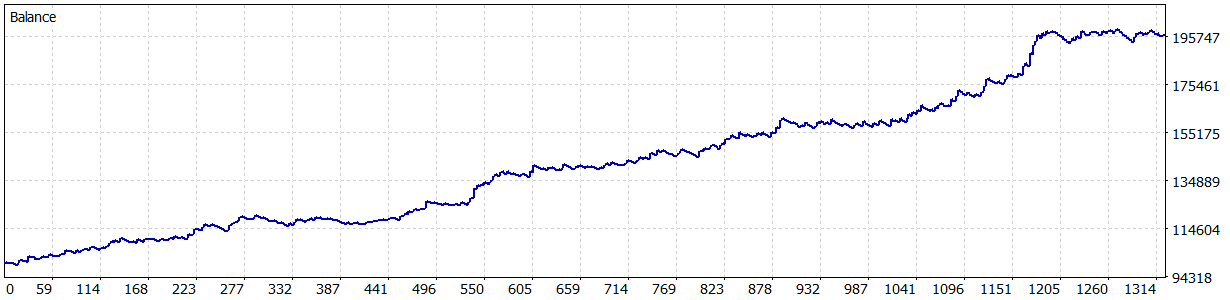

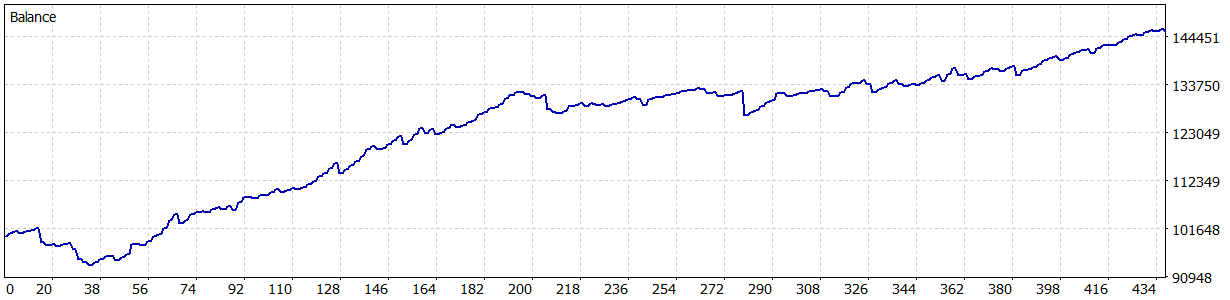

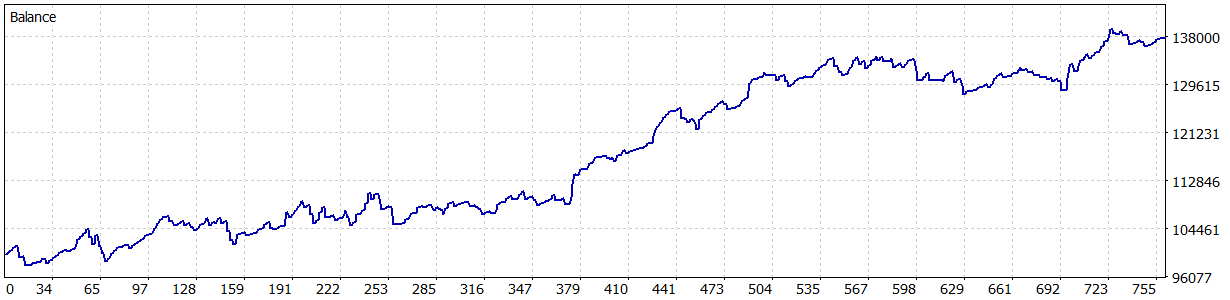

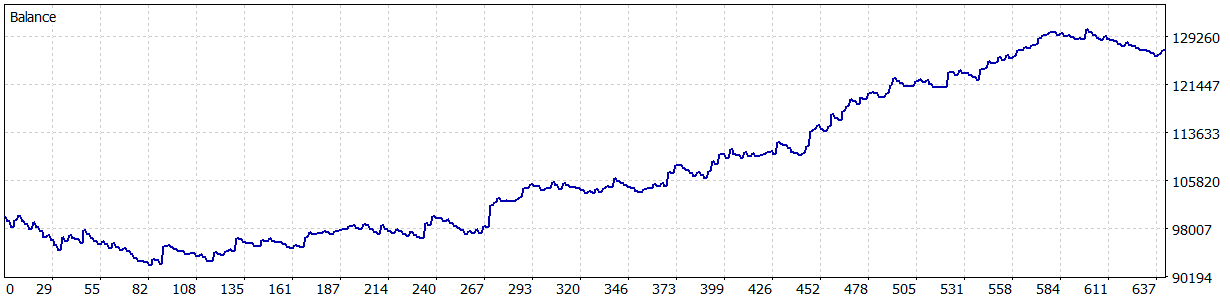

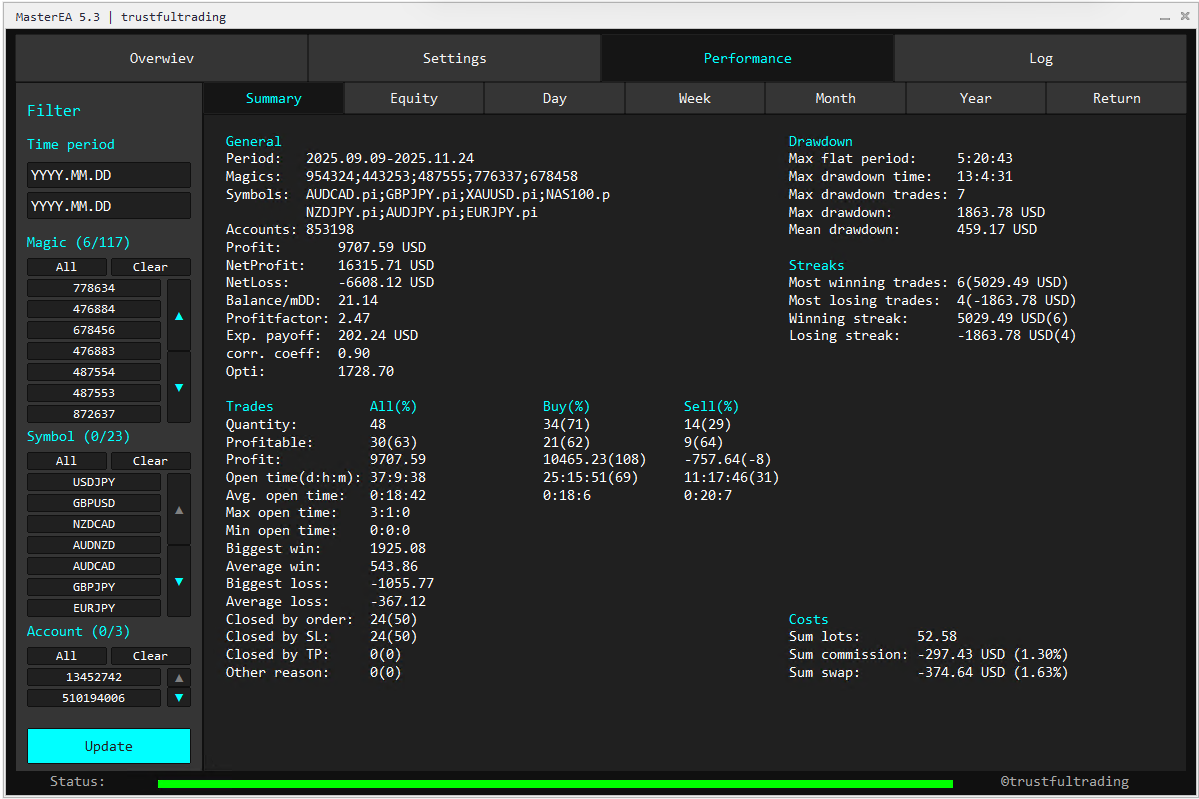

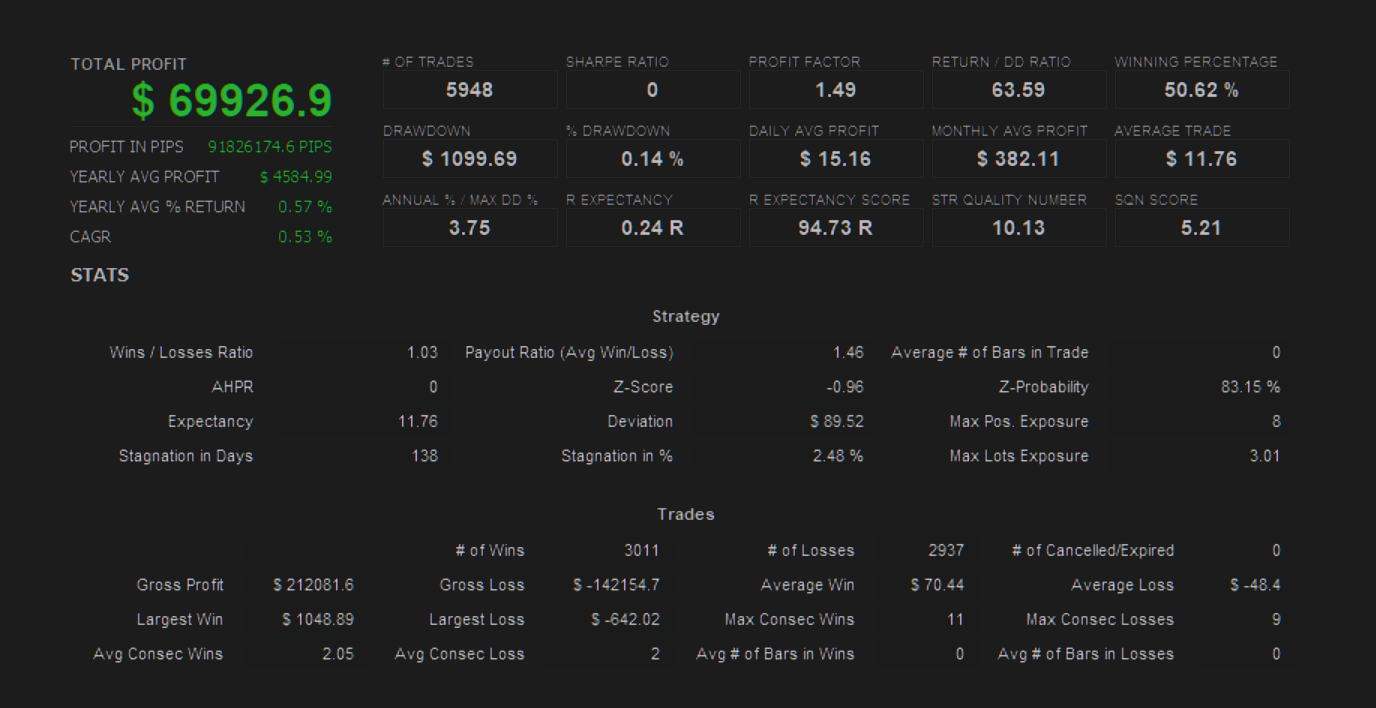

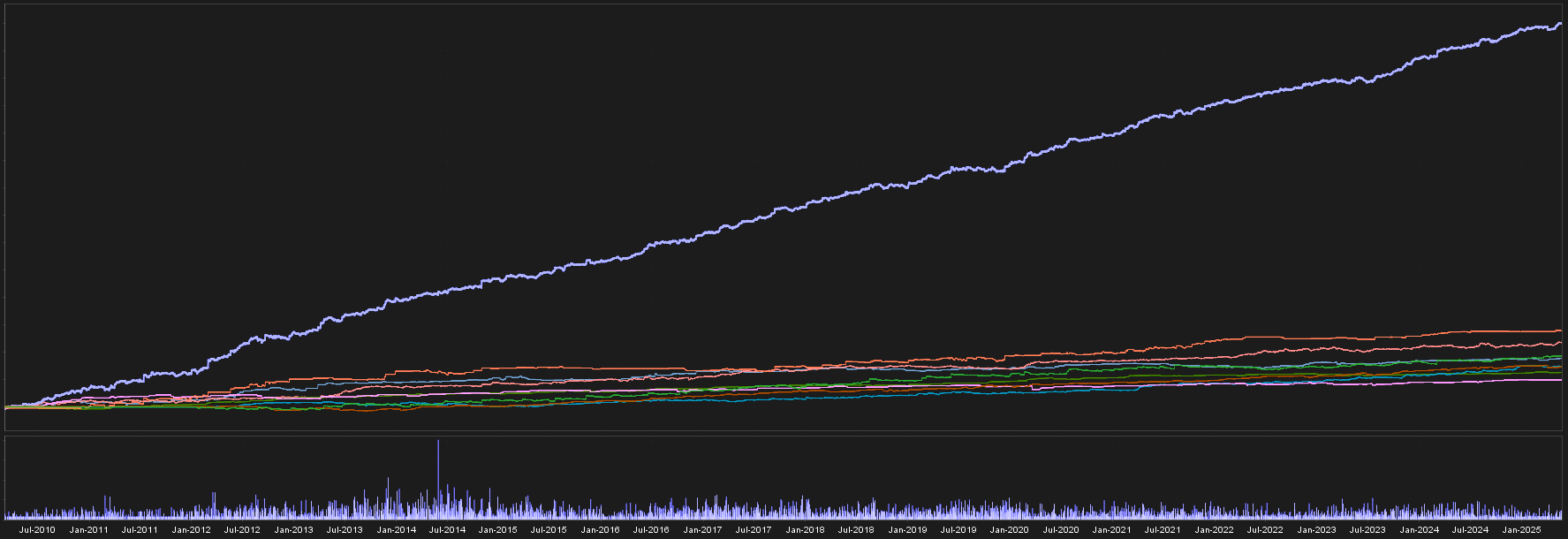

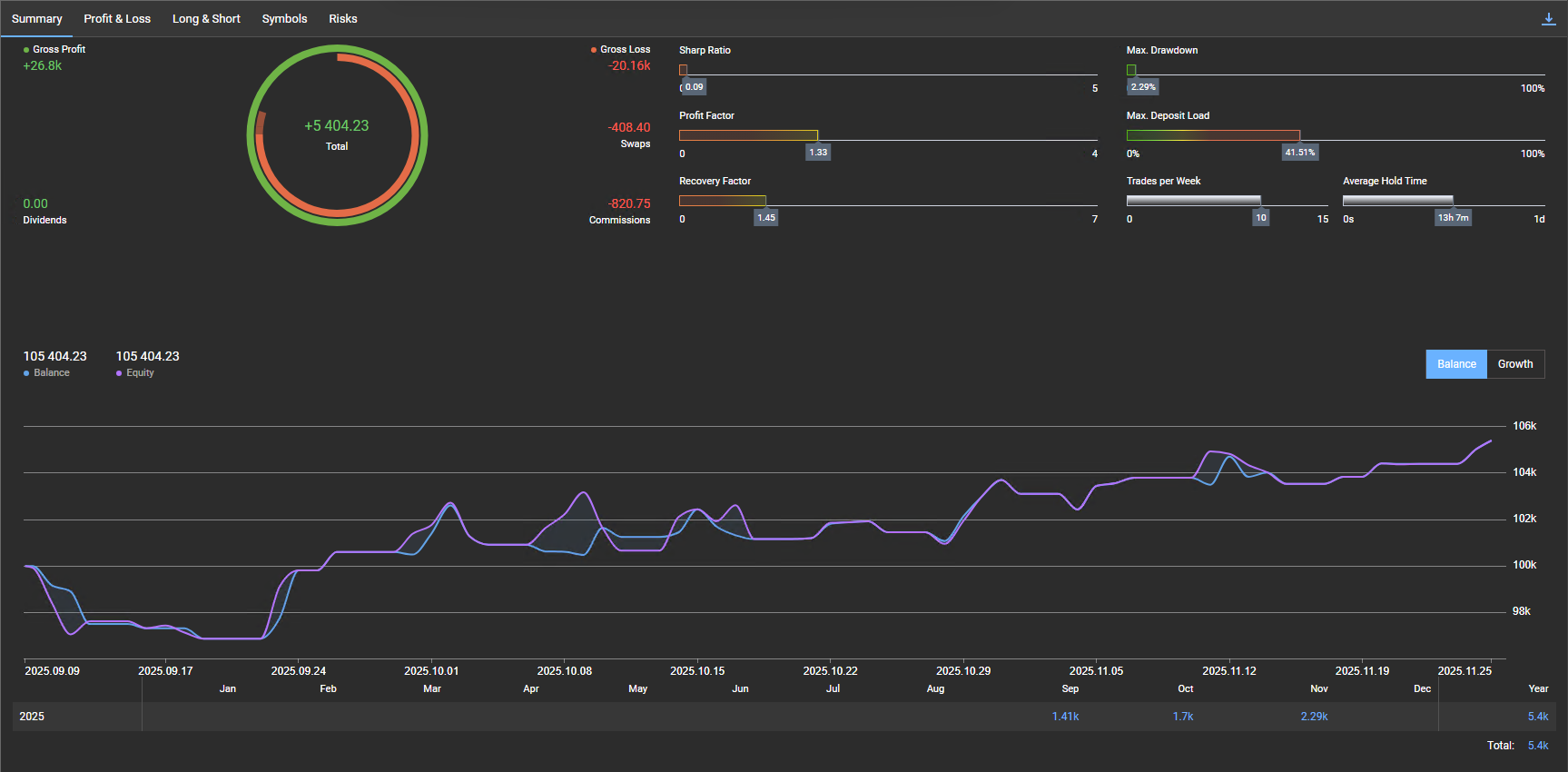

Expected Performance

Based on our >10-year backtest and live monitoring, these are the projected targets for Standard Risk settings, which can be increased or reduced to align with individual risk preferences.

TESTIMONIALS

Deployed by systematic traders worldwide

MasterEA is traded on personal, prop firm and managed accounts across the globe.

Safety Features & Risk Control

Profitable trading requires defense first. MasterEA is built on a “Safety-First” core, ensuring capital preservation is never compromised for the sake of returns.

Hard-Stop Protection

Every single position is executed with a hard stop-loss attached immediately upon entry. Your maximum risk per trade is strictly defined, protecting your capital from unexpected volatility spikes or black swan events.

Zero Toxic Logic

We strictly prohibit dangerous recovery methods. No Martingale. No Grid trading. No averaging down into losing positions. MasterEA relies on statistical edge, not reckless gambling mechanics.

Precision Risk Sizing

You retain full control. The engine automatically calculates position sizes based on stop-loss distance, account size and your personal risk level.

Modular Architecture

Don’t like a specific strategy? Turn it off. MasterEA’s strategies run independently, allowing you to curate your portfolio composition to match your personal market outlook.

Prop Firm Compliant

Engineered specifically for the rigorous demands of proprietary trading firms. Includes built-in hard limits for daily drawdown and max drawdown to ensure you never breach evaluation rules inadvertently. MasterEA’s strict risk protocols meet the requirements of major prop firms (FTMO, FundedNext, etc).

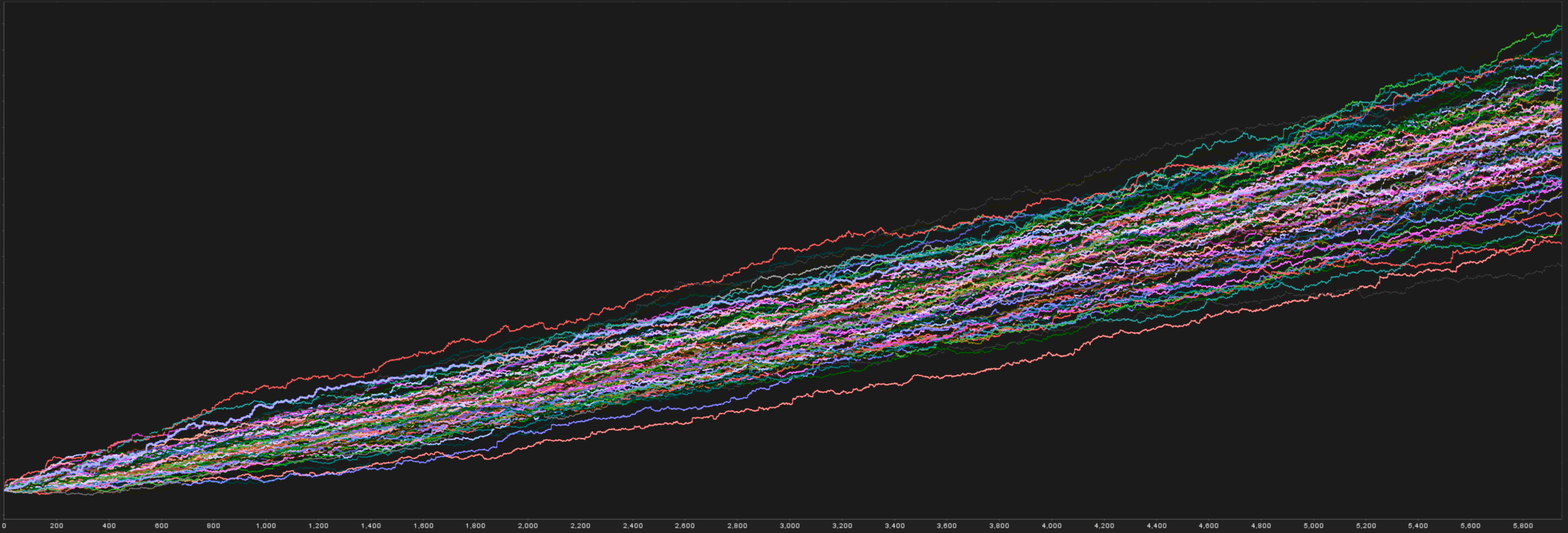

Grid and Martingale: Asymmetric Returns, Catastrophic Risk

Martingale and grid strategies often produce a very smooth, almost perfect-looking equity curve – until a single adverse move wipes out a large part of the account. They systematically increase exposure into losing trades, so losses grow geometrically while margin grows only linearly. This creates a highly asymmetric risk profile: many small, consistent gains followed by rare but potentially catastrophic drawdowns that can exceed all accumulated profits.

Schedule Your MasterEA Overview Call

30-minute session covering the MasterEA trading framework, risk controls, implementation details, and a brief Q&A.

Choose your trading setup

Transparent fixed pricing. No hidden profit splits. You keep 100% of your gains.

MasterEA licenses are strictly limited to ensure optimal support, protect existing users from portfolio overcrowding and preserve strategy robustness. This selective approach prioritizes research, stability, and long-term performance over aggressive scaling.